I’m determined to teach my kids how to be “natural savers”. I phrase it this way because I believe in learned behaviors and adaptation.

If we as parents talk about and exhibit good spending and saving behaviors and encourage the kids to do the same, they will most definitely grow up knowing how to manage money well.

I don’t actually believe we just come by things naturally, as if we are born with this gift to be a saver or a spender.

I believe that we pick up things when we are small, without even realizing it and that we are strongly impacted by things we hear and witness before we are old enough to even process the magnitude of the things to which we were exposed.

No Time Like the Present

In fact, there’s research available that says children’s money habits are formed by the young age of only 7 years old. That makes it even more important that we are modeling good money habits and even better spending and saving behaviors at an extremely young age for them.

So, I’m very conscious of my actions they are witnessing and the environment I’m fostering for my children, and if I do this properly, they will “naturally” become good savers.

For this conscious teaching technique on my part and for my kids’ subconscious sponge brains (they absorb everything!), I have decided that I will model positive habits and decision making techniques and talk about why each action is being taken.

I will use cash whenever possible, I will talk about pricing and discuss what would be the best use of our money, I will explain when it’s a great time to spend money on fun, I will help them understand what happens when we use a card (and that it’s not an endless supply of money), and I will encourage saving, giving, and spending when appropriate.

Building Their Foundation

We have had and will continue to have the open conversation with our kids about the importance of money and the fact that everything costs money.

We explain that the food we eat, whether we eat in or dine out, our home, our cars, our clothes, dog food, toys, electricity, literally – everything costs money.

The kids are only 3 and 5 years old at this point so they don’t grasp the difference between thousands or hundreds, they just know that’s a lot more than 10 or 20 dollars, and that’s okay for now.

They don’t know the specifics or even if we are rich or poor. But we are building the foundation for their understanding of basic household economics, and that’s pretty exciting to me.

We keep the conversation simple right now, while they are young, and will go more in depth as they get older.

(Affiliate links herein: See disclosure)

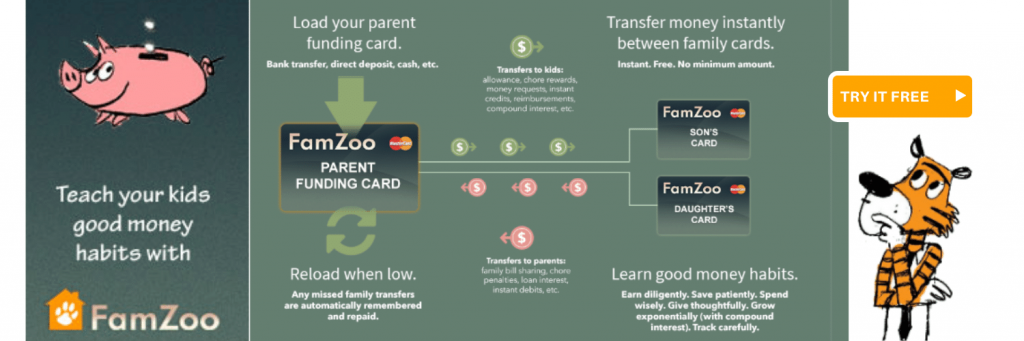

When the time comes, I’ll be so excited to use FamZoo – a parent controlled, prepaid card where I can actively teach my kids to earn, save, spend, and donate wisely within a closed banking system.

With FamZoo, parents manage their kids’ funds through pre-paid cards that kids can use directly, so that from a young age, they understand the value of money and how to make the best use of it. Which sounds to me like the best possible way for them to begin their financial literacy journey!

Opportunity for Conversation

We do enjoy going out to eat at least once on the weekend. This is a great opportunity to talk money management with the kids!

We openly discuss where we are going out to eat and how much money that costs. I’ve explained to our son why we don’t waste 4 dollars on a kids’ meal when we can get a double hamburger for $1.49.

He’s such a logical kiddo so he gets that the fast-food toys are just junk and that we’d rather save up our money for a bigger nicer toy. That doesn’t mean that he won’t stand in front of the kids’ meal toy display and long to play with those fun looking toys, but he gets it, he trusts me, and he knows I’ll say “no” and explain the logic to him again.

He also understands that if we have a coupon, it’s a whole new ball game and that we will occasionally take advantage of such a situation.

Don’t get me wrong, these kids are not deprived in any way. But they do understand that when we get a kids’ meal, it’s something to be thankful for!

Modeling Frugality & Getting Ahead

The kids don’t know what their missing out on or why unless someone points it out to them. So the best time to scrimp and save and be cheap is when they’re little.

They also don’t know the difference between eating out at a fast food restaurant once a week versus a fancier, sit down-type place multiple times a week.

Why? How? Because we’ve never done that. Because we’re choosing to allocate our cash differently and work toward our savings goals and talk about that openly with them.

It pains us to spend $20 on each entrée, plus tip at a more formal restaurant when our kids would be happier going to eat somewhere with a play-place at a fraction of the cost.

We don’t feel deprived, because we know that in the long run, we’re getting ahead and we’re taking every opportunity to change the trajectory of our kids’ lives.

Making our savings goals and teaching them to be frugal are more important to us than being seen in or experiencing a fancy place. Furthermore, allowing our kids to have a blast in the tunnels and seeing the joy on their faces, while meeting up with neighborhood friends, is more valuable to us in a different way.

When we do go out, which is only once or twice a week, we save money, take the kids somewhere fun, and work toward our goals all at the same time. How rewarding!

0 Comments