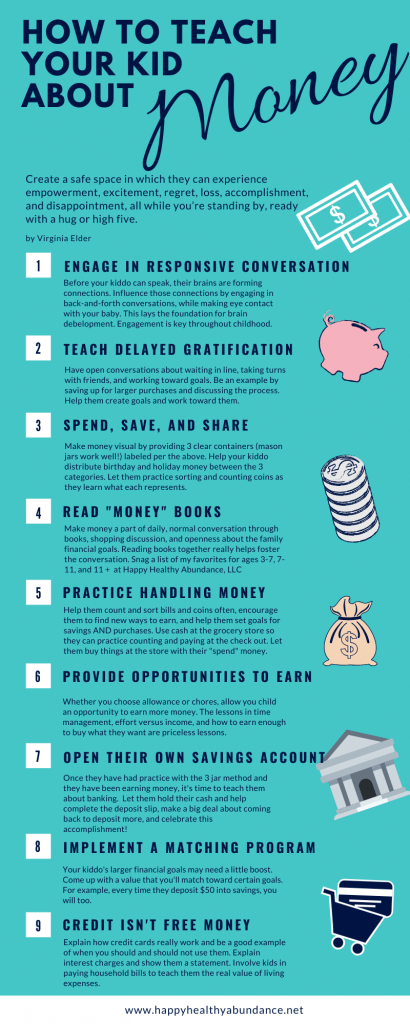

How (& When) to Teach Kids About Money

A question I receive from moms most often is “When Should I Start Teaching My Child about Money?” And my answer to this is “Right Away!”

It’s never too early and it’s never too late.

I look at the money conversation just like the other awkward subjects we’ll eventually have to discuss with our children like drugs, alcohol, and sex. If we don’t talk to them about it and teach them what we WANT them to know, they are going to make their own assumptions about things and learn who-knows-what from their friends.

You and I both know that most of the detail kids get from their friends is bad or false information. I’d prefer to tell them the facts, so that I know that they know, without a doubt, the truth, so they can make smart, informed decisions when they need to.

Listen on iTunes | Listen on Spotify | Listen on Stitcher

Episode 7 on Reaching Abundance: How to Teach Kids About Money

Money is an essential part of life. So, as much as we mamas harp on brushing teeth correctly, we should be talking about basic money concepts and integrating price comparisons, math, and value into everyday conversations.

This topic is super interesting and exciting to me, but also one of my favorite parts of working with women and money. I love when I get to not only help a mom get a better grip on her household finances through coaching but when I am also able to guide her through teaching financial concepts to her children while she’s going through her journey. I provide insight on phrases to use, activities they can do together to teach financial skills, and even books to read together.

Where do I Start?

One thing’s for sure, by being intentional about money with our children, we’re positively altering their future. The only thing you can do wrong here is to completely avoid the subject.

The world of personal finance is HUGE, so it’s easy to get overwhelmed. But let’s be realistic here, a 3-year-old won’t understand compound interest if we barely do! Right?

For this reason, it’s important to understand some important brain development milestones, why things like neuroplasticity are important, and dive into the stages of child development. Separating these stages, and what children can understand cognitively by age group will help us understand what to teach at which age, and why.

Before we get started, here’s an amazing fact (revealed by The University of Cambridge) to remember:

Children as young as 3 years old can understand basic money concepts,

and children develop their money mindset by the age of 7.

What this means is that by the time a kiddo is 7 years old, in the child’s mind, they’ve witnessed enough to determine their perspective about money. Their subconscious has decided whether it’s good or bad, scarce or plentiful, whether it’s helpful or hurtful, etc. They likely can’t put it into words, but whatever connections they’ve mentally formed by the age of 7 will be reflected in their adult financial behavior.

So, basically, the way they are going to act with money as adults is already determined by experiences that they probably don’t even remember. Now, I’m with you if you’re thinking this is a little freaky.

If your children are older than 7, don’t panic! They aren’t broken. You haven’t blown it. You just need to start. Plus, it helps to understand a concept called neuroplasticity (keep reading!).

New Pathways

The first key to teaching kids about money is to be a good role model. Build savings and practice self-control with your spending behavior on purpose, so that you can honestly discuss things. As always, no matter their age, they will learn more from what you do than from what you say.

But did you know you can do more than just model good behavior? Did you know you can actually influence the way the neurons in your child’s brain make connections?

Now, **disclaimer here** – I’m no scientist, surgeon, or child psychologist, but this stuff is absolutely fascinating! It shows us so clearly how and when we can teach our children about money, based on the developmental stage of the child’s brain.

Neuroplasticity is what happens inside our brains when we have an experience that shapes us, that changes our minds, or that makes us alter our actions in a certain way. The neurons in our brains form new pathways and new connections.

Much like if you previously thought you hated running, but you had a girlfriend who invited you to go with her. So you went, and you had a great time! Next thing you know, you begin running as a regular form of exercise because you’ve discovered how much you enjoy that time to yourself. (This happened to me!)

I actually altered the connections in my brain from Running = Bad to Running = Joy

This can happen in adults’ minds and children’s’ minds alike. So, it’s important to realize that a positive experience with anything at any time leaves an impression. (This is why it’s never too late!) And that that positive impression has the ability to grow into a full-on behavior – maybe an automatic positive correlation between abundance and money? Heh?

Larger Surface Area

In addition to the concept of neuroplasticity, children’s brains are forming new connections between neurons by the second. By the age of 3, a child’s brain is forming 1 million connections per minute. Their attachment style, reactions, attitudes, engagement, and responses are all being formed and learned at a pace that’s hard for us to fathom.

This is what’s amazing to me though – the more you engage in responsive conversation (This means asking questions, providing eye contact, and interacting) with your child – about money or anything else – the more you’re influencing those neurons. Studies show that some children witness more than 30 million spoken words by the age of 3 and that the cortical surface area of the brains of children who witness responsive conversation is larger.

Scientists have shown that children with larger cortical brain surface have stronger language skills, a larger vocabulary, are able to avoid distraction and exert self-control, and are able to engage more strongly as an older child/ adult. These factors influence their ability to read and develop future relationships. Amazing, right?

Brain Stuff Summarized

So all of this brain development lingo points to a few simple instructions.

1) No matter your child’s age, engage in conversations with them. It doesn’t matter if they are 1 and can’t answer back yet. If they are older and able to answer, help coach them on how to express themselves clearly. Teach them which phrases they can say to accurately convey what they would like to communicate.

This engaging, responsive, back and forth conversation helps develop their brains, their language skills, and most importantly, their perspective of the world.

2) Model Positive Behavior. Again, the kids’ ages don’t matter. They are witnessing our attitudes, the words we use, and our actions and their neurons are forming millions of connections per minute based on what they witness. Let this be even more encouragement and proof for us as parents that they will do as we do, not necessarily as we say.

If you practice budgeting, saving, and exhibiting self-control, discussing your thought processes around money with your kids will be easy.

If you practice budgeting, saving, exhibiting self-control, and sound financial decisions, discussing your feelings and thought processes around why you’re doing what you do will be easy. You’ll be telling the truth, teaching from reality, and able to provide sturdy support for the concepts discussed.

The Breakdown: By Age – Child Development Stages and Money Lessons

Birth – 2 Years Old: Sensorimotor Stage

During these early years, your baby develops an understanding of the physical world through senses like touch, taste, feel, and smell. They begin to grasp their bottle, graduate from milk to baby food, gravitate toward blocks or balls, and learn to crawl and walk.

Everything is related to a sense or understanding of an object and what it does as it pertains to their life. For example, even though they can’t verbalize that their blanket is soft, they require it touching their cheek in order to sleep.

During this phase, you aren’t teaching your child about money. You are, however, teaching them things that turn into money skills. Reciting ABC’s and numbers 1-10 as you stack blocks high, reading bedtime stories, practicing ask and answer conversations, and playing peek-a-boo influences how the brain’s neurons are connecting.

Babies learn through a process called “serve and return”, which is basically their version of cause and effect. For example, if they cry, you pick them up, if they drop their spoon, you give them a new one, and if they hide their face, you’ll play peekaboo.

Although there aren’t actual money lessons happening here, this is still a very valuable, important time for brain development, and, of course, furtherance of your personal and emotional relationship with your baby. These simple games and fun interactions with your baby are laying the foundation on which number concepts, vocabulary, and mindfulness will be built.

3-7 Years Old: Pre-Operational Stage

It’s during these early preschool through 1st or 2nd-grade years that your child is developing short and long term memory, imagination, concepts like past, present, and future, and beginning to understand symbolic representation. Their attention spans are developing along with their auditory processing skills, which lead to reading. Near the age of 6 or 7 years old, they enter the early stages of understanding logic, cause and effect, and reasoning.

This one stood out to me because I remember all too clearly the frustration at why on earth a 4 or 5-year-old cannot understand the concept that if you do this… this happens. Until I found this out – trust me, it was a challenging conversation between the hubs and I as we tried to come up with better parenting strategies for our, then 3 and 5 year old, kids with the knowledge that they do not even possess the ability to reason or understand what we consider simple logic.

Cause and effect, logic, and what we may even refer to as common sense aren’t even possible in a child’s brain until they are at least 6 years old. Even then, it’s iffy until they are older.

So this is where it gets fun because as your child develops, you can play different games with them, read money-themed books, practice counting coins, establish an allowance or chores, open a savings account, and start integrating simple math and values into everyday conversation.

This 4-year gap from ages 3-7 is a big one, with lots of mini developmental milestones in between, so now that you know the overall development that’s occurring within these years, let’s break it down further.

(3-5 Years Old)

The activities you can do and the conversations you’ll have are likely going to be very different from a kiddo in the 3-5 range versus a 6 or 7-year-old. So, here are some activities you’ll want to implement in the younger years:

Delayed gratification is a rough concept for us adults, likely because it wasn’t taught and practiced intentionally with us as children. This is where we have the opportunity to change our children’s trajectory and make their future better than ours. Find simple opportunities throughout the day to discuss openly and create rewards for patience.

3 Simple Steps To Teach Delayed Gratification:

When waiting in the grocery store line, explain why we should wait our turn and how rude it would be to push everyone out of the way. Draw a similarity to when they are at the park and want to swing, but all the swings are being used.

Savings Goals: Come up with something that you’re “saving for”, like maybe a $20-$50 item. When you see that item at the store or online, point it out and talk about why you want it. Explain that you’re not buying it today because you’re using your money for other things right now. But also explain that in just (insert time here – two weeks?) You’ll save up your money and buy it. Make this visual by showing them cash amounting to 1/2 of the purchase. Explain that after more work, in one more week you’ll have what you need to buy it.

Discuss the math openly like, “I have $10 right here in my hand, but see?” Pointing at the price tag, “I can’t buy it until I have $20.”

Follow through and over the next week show your kiddo the other half of the cash. This is a great opportunity to count money together, talk about the value of things, discuss waiting for things you really want, and teach about working toward a goal.

Combine Waiting with the Goal: Finally, buy the thing with cash when your child is with you. Celebrate that you “saved up” for this thing, patiently waited to purchase the item, and talk to them about how they can do it too.

Rinse and repeat often – at least a few times a year. This isn’t a one-and-done lesson. Tweak and modify these exercises as you see fit. The main things to focus on are to teach them how to wait, practice counting/ math skills, introduce the concept of trading money for goods, and encourage discussion about goal setting and the fact that we can buy anything, just not everything.

Categorize Money Visually: I do suggest creating 3 clear separate piggy banks – mason jars work great for this- and explaining to your kiddo that one jar is for each spending/ saving/ sharing. As they accumulate birthday or Christmas money, divide the earnings evenly among the jars.

Read Books Together: For kiddos between the ages of 3 years old and 7 years old, you’re likely reading a bedtime story every night, and I’d love for your to work into the reading schedule a few of my favorites (affiliate links herein):

Curious George Saves His Pennies

Berenstain Bears’ Trouble With Money

Dr. Seuss’ Once Cent, Two Cents, Old Cent, New Cent

Alexander, Who Used to Be Rich Last Sunday

Complete list available for download here.

Work with your 3 – 5-year-old so they learn that things have value, begin to recognize and sort coins, practice counting, and differentiate between things they want more than others. Create opportunities for them to just Practice Handling Money. Give them a couple of bucks and allow them to pick out a fruit they want for a snack. Give them $15 and let them choose a new book at the bookstore.

It doesn’t matter at this point if they are using their own money or yours, the simple fact that you’re creating a space in which money is not a taboo topic – where you’ll walk them through making good choices and answer questions that they have – is what’s important at this age.

Since a 3-year old’s comprehension (and likely language too) has developed, ensure you’re Using Positive Money Phrases around your own finances and purchases. This will be the foundation of later teachings when they are older.

This includes saying “We’re making different choices with our money” instead of “We can’t afford that” when your child asks for an expensive toy.

Refrain from muttering “Everything’s so expensive” under your breath and instead, say “The world is full of options, and I’ll find an affordable solution” when faced with a difficult choice.

One of my favorites my son and I say to each other is “I have the power to solve my problems. I can do this. I believe in myself”- we practice taking deep breaths and then listing off 3 potential solutions to whatever he’s facing. It’s really helped him over the past few months!

For more phrases and examples of what to say (and what not to say), I’ve compiled a free downloadable list of positive money mindset phrases for you. Some of which, you can even tweak a little and have your kids practice to encourage themselves in a tight spot.

(6-7 Years Old)

Around the age of 6 or 7, your kiddo is ready to learn how to earn money. Whether you want to set up an allowance or a chore-based commission system is up to you, as long as you Provide an Opportunity to Earn. There’s a great big debate out there as to which is best, and I won’t get into that. We believe in a combination of these methods, and that neither will “ruin” your child.

The point of your child earning money is for them to gain experience handling money. For them to understand the value of their time and effort as compared to the cost of the items they want, is a priceless lesson.

Establish a visual chore chart, popsicle stick reward system (pictured below) or whatever works for your family.

- Here’s a list of age-appropriate chores by year.

- Here’s a list of great, visual chore aides for your kids, like charts, jars, magnetic boards, etc.

Practicing With Earning, Spending, and Saving small amounts of cash translates into life skills that will help them be successful adults that can’t be taught any other way. You’re creating a safe space in which they can experience empowerment, excitement, regret, loss, accomplishment, and disappointment, all while you’re standing by, ready with a hug or high five.

Parenting: Creating a safe space in which they can experience empowerment, excitement, accomplishment, and disappointment, all while you’re standing by, ready with a hug or high five.

I much prefer for them to go through this while under my wing, rather than experience these things at the age of 18 or 20 when the stakes are higher and when I have limited ability to protect or guide them.

At this point, it’s possible they’ve been using the 3 jar method (spend/ save/ share) for a few years. When they have the opportunity to earn, either via allowance or chores, it’s time to Open Their Own Savings Account at the local bank branch.

Make a big deal and amp up the excitement about your kid opening their first bank account. Physically take them to the bank, allow them to hold their cash, and involve them in filling out the paperwork. Help them be proud of this milestone and explain that you’ll bring them to the bank anytime to add money to their new bank account.

Implement a Matching Program (I suggest providing clear guidelines on minimums and maximums, by the way) so that your kiddo is even more excited to earn and save their money.

All the while, continue allowing them to learn the names and values of the different coins and bills, explain to them what a check is (maybe write them one some time), and allow them to practice handling cash. Teach them to set savings and purchase goals. Help them track toward those goals with visual representations like coloring sheets (free download available here) or charts.

Along these lines – if you want to implement a card-based system instead of using paper cash, I support this as well and recommend you check out this company called Famzoo.

7 – 11 Years Old

Between 7 years old and the pre-pre-teen age of 11, children develop awareness of external events, basic understanding of how the world works, other people’s situations and feelings, and have a much clearer comprehension of cause and effect. Their logic is developing strongly and they are able to differentiate between concrete and abstract ideas.

At this age, Your Financial Behavior as an Example is imperative. This doesn’t mean you have to be perfect, be debt-free, or put up some front about money. It means you are the person they look up to and learn from the most, and that they WILL mimic the things you say and the way you behave.

Allow your spending decisions (like why you’re choosing the generic brand) to be Open Discussion and part of normal conversation. Encourage them to weigh in on which item they think should be purchased and if the additional money for the name brand item is worth it. Allow them to be involved – ask them to help you find coupons or compare grocery ads. Ask them if they’d rather do this or that for entertainment while weighing the costs of each.

All of this to say, basically make money and choices a part of their daily lives, not some taboo subject or something that’s awkward or avoided. When a child feels involved and that their opinion matters, they are more likely to participate. Continue to help them set goals for spending and saving. Open their eyes to opportunities for “sharing” their wealth (i.e. charities that spark their interest), and begin to expose them to deeper, broader financial concepts.

An older, pre-teen, kiddo can grasp larger numbers. So this is a great opportunity to Involve Them in Paying the Household Bills. It’s important for them to see that, even though your paycheck may seem eye-popping huge to them, it goes quickly since you’ve got to pay the mortgage, car payments, basketball, dance, utilities, etc. They need to understand the value of the electricity and water that they take for granted daily. It’s also important for them to begin to have the awareness that $3000 or $5000 or whatever doesn’t actually pay for that much.

Take advantage of their expanded math skills and show them the in and out fluctuations of money in your bank account. Show them what you’re saving, what it’s for, and why you want them to be better at it than you are (we all want that, right?).

Around the age of 10, they should be well versed with earning, saving, and spending cash and hopefully, they’ve had several months, if not years, of you talking to them about money. At this point, explain The Difference Between Debit and Credit Cards (if you haven’t already) and make sure they know that credit is not just free money.

Begin to talk with them about the power of advertising and open their eyes to the fact that everyone wants them to buy their product. Further the discussions about choices, saving toward what you really want, and encourage them to notice when they are being persuaded or advertised to.

During the concrete operational stage, kids can understand financial concepts almost as well as any 18-year old. It’s during this stage that it’s important we continue to guide them- so that they aren’t “winging it” when they are 16 or 18 or 20.

When a child is 11 or under, they haven’t quite hit their rebellious stage and they don’t drive or work outside the home just yet. For these reasons, among others, parents still have the utmost influence over what is right or wrong for their child. So, take advantage of these early years and Teach Your Child the Things You Wish You Knew.

Rack your brain and try to remember those slap-in-the-face moments you had with money in your teens and early twenties. Back-track from those rough patches and create lessons for your child in order to help them avoid those same shocking moments.

At this point, the bedtime story thing has sadly disappeared and your kiddo is independently reading. Stop by the library, half-price books, or even just click the (affiliate) links below to snag these, more mature kids money books:

Neale S Godfrey’s Ultimate Kids’ Money Book

The Everything Kids’ Money Book

National Geographic Kids Everything Money

The whole, comprehensive list of kids’ books, divided by age, is available here.

Beyond 11 Years Old

As your child grows into their teen years, explain more detail about credit, FICO scores, loans, compound interest, earnings versus budgeting and saving, and most importantly, net worth. There will be many excellent opportunities to discuss these things as they get their first job, set up their first contributions to retirement, and bring home their first paychecks.

Continue to share how to budget, teach them to address savings and needs over wants, and help them build confidence in managing money on their own. Show them the ropes as they set up contributions to their first retirement account.

At this age, they can read books that cover much more advanced money topics. It’s typically during these years that we start to see their rebellious side too, so I suggest just buying a few of these and having them around the house rather than pushing these on them as some sort of “required” reading. Some you may even want to read alongside them.

Here’s a list of my faves for older kiddos (affiliate links herein):

The Money Class: A Course in Basic Money Management for Teens and Young Adults

What All Kids Should Know About Saving and Investing

The Young Entrepreneur’s Guide to Starting and Running a Business

Loaded: Money, Psychology, and How to Get Ahead Without Leaving your Values Behind

How to Manage Your Money When You Don’t Have Any

How to be Richer, Smarter, and Better-Looking Than Your Parents

The whole, comprehensive list of kids’ books, divided by age, is available here.

If you’re rusty in any of the areas and aren’t sure how you’d explain it to your kiddo because you’re not even clear on it, let me know. This is a good thing!

The fact that you want to make your child’s life better is amazing, but since you’re willing to change and grow and learn yourself in order to facilitate the process with your child is astounding. I’ll direct you to a post I’ve written or maybe I’ll even create one tailored to your specific need.

The Basics of Teaching Your Kid About Money

Okay, so after all this detail, what are the Boiled-Down Basics of Teaching Your Kids About Money?

- Be a good example. Let your spending reflect your values. They will see your behavior and either mimic it or ask you “why?” Which will be the perfect opportunity for a money lesson 🙂

- Encourage conversation. Talk about choices, values, and numbers openly with them. Share your thought processes, goals, strategies to reach those goals, and why you value the things that you do. Ask them what they value and why.

- Provide opportunity. When they are tiny, you’re providing blocks and silly games, which may not seem like much, but they are important opportunities for your baby to be exposed to language. When they are older provide them with an opportunity to practice saving, spending, and sharing their cash. Give them visuals like savings jars, chore charts, and coloring sheets toward their goals. The older the kids get, the more practice, the bigger the numbers, and the more “real” opportunities they need.

If you continue to guide, speak openly, and teach with their positive growth in mind, you’re on the right track! And if, by chance, you read this whole thing in fear because your kids are older and you haven’t done any of this, don’t panic!

You CAN start anywhere at any time. Start with the concepts you’d teach a very young child and escalate them quickly since your older kiddo is going to grasp things quickly – you’ll still teach all the same concepts, just in a modified time frame.

Let me know if you need help with this. We can come up with a plan so you nor your kiddo gets overwhelmed and so that you do things in just the right order.

0 Comments