Okay… now maybe this is the post you’ve been waiting for – How to actually go about choosing your investments. This is post 11b, incase you’re wondering, the last of the Mama’s Abundant Money Series!

I just HAD TO breakdown some of that investment terminology mumbo jumbo and address the fee situation in “Dreaming of the confidence that comes with being well invested?” first. So, now let’s talk about the real action – choosing your investments!

There are a million different types of funds, bonds, CD’s, and other options inside your retirement account, for example. I’m a big fan of funds, whether it be mutual funds or exchange traded funds, since they are a conglomerate of many company stocks.

For me, I see the benefit in funds because they are less risky than single stocks because of their inherent diversification, you have access to steep returns (better than CD’s or bonds), and make no mistake, all of these options are way better than just holding onto your cash.

Investment Fund Choices

I personally own mutual funds, target date funds, and exchange traded funds inside my investment accounts.

Target date funds, named by the year you plan on needing the money (2045?), are considered extremely long investments and are structured so that the highest degree of risk is early in the investment period, with asset allocation adjusted yearly toward less risky options as the target date approaches.

In English, this means that the stocks inside your target date fund will be traded over time so that your investment’s risk gets lower as your cash-out date gets closer. Currently, my investments are most risky because I expect to have 30+ years before I need the money, and hopefully that’s your situation as well.

Mutual funds are a group of stocks, bonds, options, and more that is managed by an investment company. An exchange traded fund is similar because it’s also a group of securities, but different because it’s traded in real time on the stock exchange, whereas mutual funds only trade once a day.

There are more options when it comes to buying and selling ETFs, like short sells, and buying on margin (none of which are important right now – we’re sticking to the basics here.)

Honestly, I own both of these types of funds too, just another way to “spread the love” and make sure I’m diversified as far as fees, types of securities held, and long (30 year) and shorter, but still long-term (10 year) investments.

Okay, so I have to pay attention to the stock market now, right?

Once you’re invested, how often should you track your investments?

Investing, for most of us brings up memories of our parents watching the TV fearfully as the stock market tanked in either the 80s or the early 2000s or maybe both, which is exactly why we have anxiety about it.

I’ll reassure you first hand that much of the knowledge we have access to now wasn’t available then and I’m pretty dang sure everyone was up in arms during these two recessions because yes, it was bad, but also because most people were invested in single stocks.

On top of that, day trading was trendy back then – only when so many people got burned did they wise up and realize they shouldn’t play with fire.

It’s important for us to realize that when you’re putting money into a retirement account, it’s called long-term for a reason. Because there’s absolutely no way that you should be concerned with the daily fluctuation of the market!

Even drastic fluctuations form year to year won’t matter much, because guess what, if you’ve got 30 years to go, that’s 30 years of 365 days each of ups and downs. Watching the stock market and checking prices daily or even weekly would be enough to drive you batty.

My advice? Turn off the ticker, avoid listening to media hype, and realize there’s no timing the market. Do your research, put your money in well-researched investments and let it go.

How to select funds inside the investment account

So, now you’re wondering how to pick out a fund. What should you look for in a fund? How do you know if it’s a good buy? And How do you compare funds?

Luckily, I had some cash in my retirement account recently that was unallocated, so I went through this process and was able to pull in some step-by-step screen shots for you!

I personally have my investments with and am a big fan of Fidelity. So, all of the below information and pictures are from their site.

Here’s the big disclaimer on this piece, are you ready?

In no way am I telling you to invest in Fidelity, the funds I choose, or even to follow my exact methodology when choosing your own investments. The below is an example of SOME of my thought process on that particular date/time. I don’t claim that my process or investment choices are perfect and you should not take this as investment advice.

Whew! Now that that’s out of the way, this is how things typically go. When you have an IRA or 401k, the cash you put in the account winds up in a “cash” bucket, which is essentially a holding cell until you decide what to do with that cash inside the account.

With Fidelity, it’s called a Cash Reserve account as shown here:

Depending on your employer and the type of account you have set up, your cash may automatically have you invested in the company stock. With some accounts, you can choose an allocation percentage and the funds you prefer when you first open the account and avoid the whole cash reserve situation.

In this particular account, I have the whole cash reserve situation happening, so occasionally I have to log in and decide what to do with it.

My basic advice on choosing investment funds is to trust the pros. There are people that have a dedicated career to fund research and analysis for a reason. Use sites such as Morningstar, Zacks, Fidelity, E-Trade, and Vanguard (there are many more too!) To read up on things.

It’s so easy these days to just type in “Top ETFs” or “Favorite Mutual Funds” into Google. Don’t be afraid to do just that and just see what the pros say. By no means should you just buy whatever they recommend without looking into the funds further, but it’s a great starting point. (How do you think I got started?)

Most broker sites, like Fidelity, for example, have a comparison tool or screener where you can sort, choose, include and exclude characteristics. Treat it just like you would if you were comparing shoes or the latest baby swing online. Read through the features, check out the length of time it’s been available to the public, and read into what people say about it.

How I Selected an Exchange Traded Fund

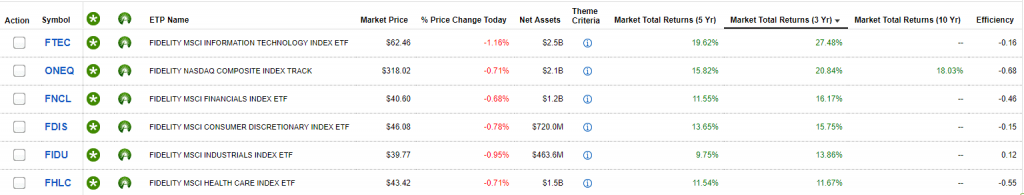

In my case, I wanted to buy ETFs (Exchange Traded Funds) with my cash reserve. I want something with a 5-10 year history, pretty dang low fees, and strong growth. Sounds like a job for the screener!

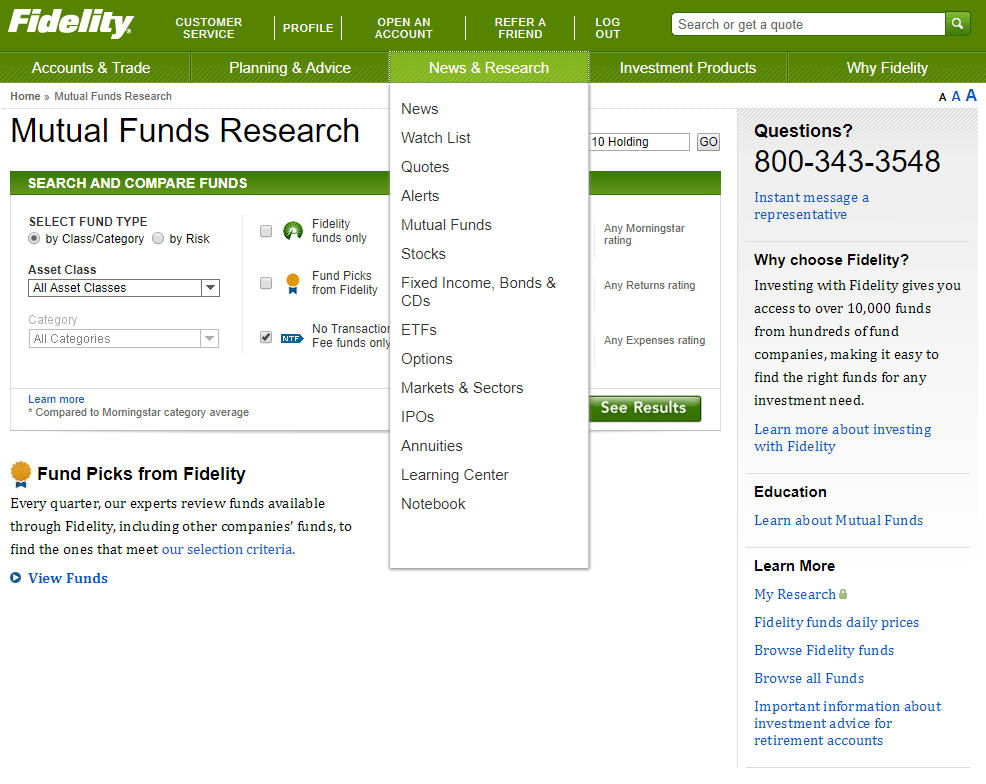

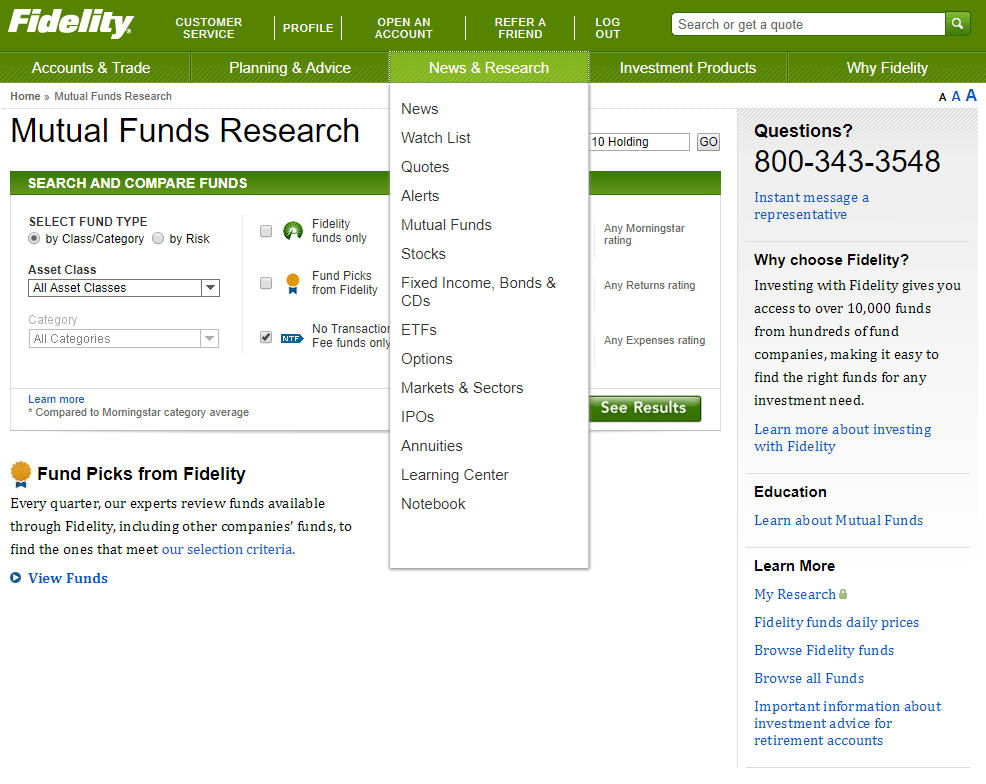

I’m easily able to select News & Research at the top of the screen and proceed to ETFs where I’ll conduct my comparison.

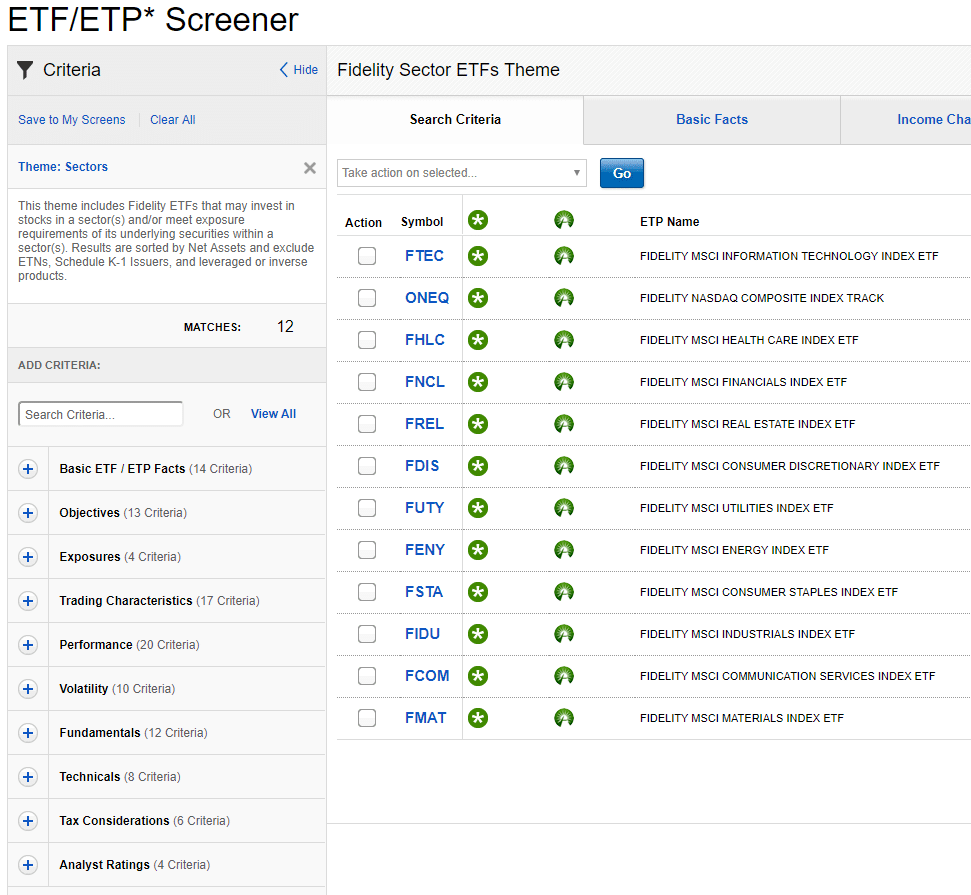

Right away, all ETFs available are listed. Using the menu to the right, I’m able to expand and select certain characteristics and the list of ETFs is narrowed automatically to fit my criteria!

So far, this is just like shopping on the Crocs website for shoes (which I also did recently) ha!

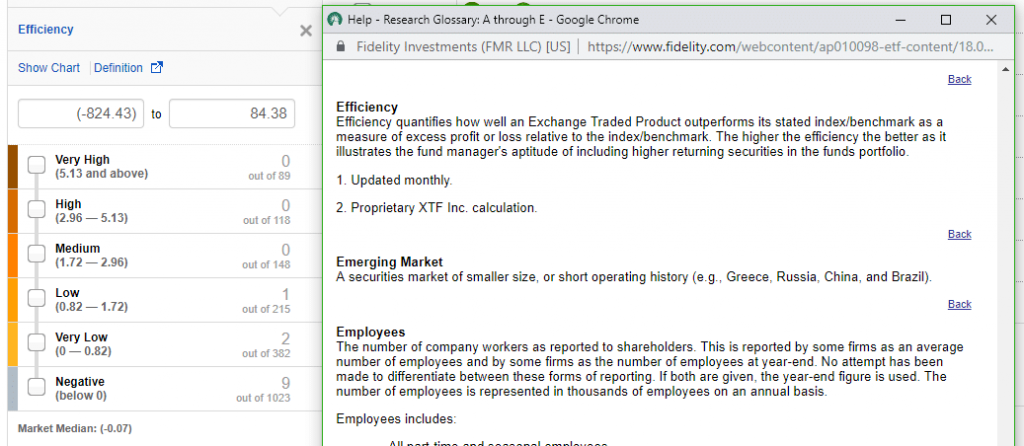

The “Efficiency” tab caught my eye. I like things that are efficient, don’t you? Hmmm, I click on the little definition box and check out what it says.

Boom – there’s an explanation for whatever I need. And I can see how efficiency would be beneficial when it comes to money

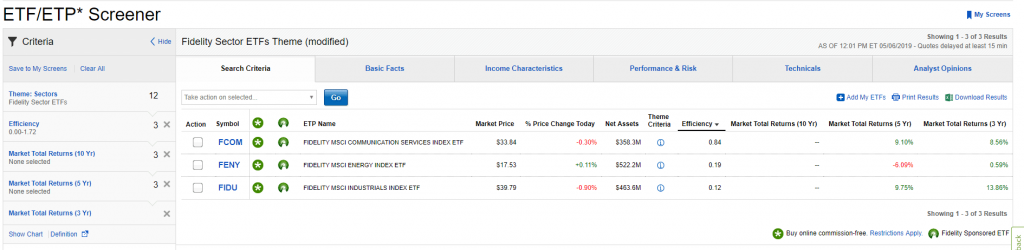

So, I selected the 3 funds with a positive efficiency and a few of the options for total returns over long term periods, I’m quickly able to see that none of these are over 10 years old, and that only 2 of them have positive returns over the 3-5 year range.

Based on this information, I’m probably going to put my money in the two positive funds.

I unchecked the efficiency rating and decided to focus on the long-term performance of these funds instead.

See? You can check out features, adjust, change your mind, and decide to focus on what’s important to you.

Within the chart, you can click on the headers to sort from high to low – this makes it easy to see the top performers.

When picking funds, there are different ways to buy – market orders, stop limits, and more. I have to look them up every time to make sure I know the name of what I want to do so I can execute the order correctly.

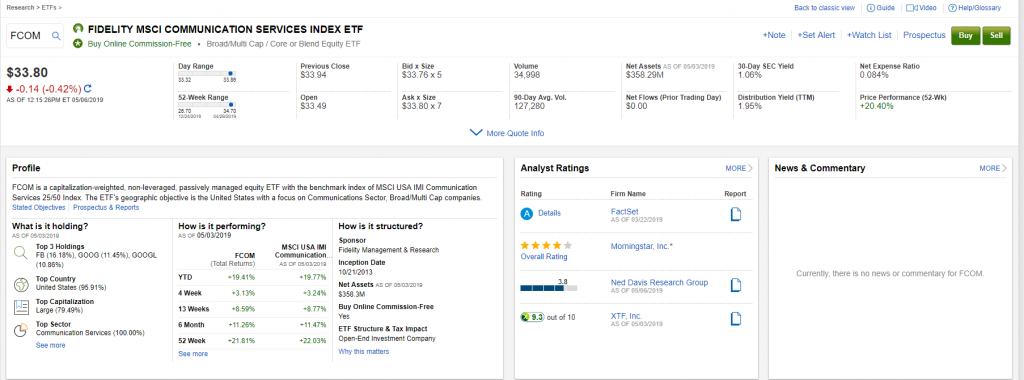

I click on the prospectus page for each of the top 5 funds I’m considering and I write down the current price.

I always check out the quote page for the fund, there’s a ton of info here – graphs for last year’s overall performance, current price, the highs and lows over the past 52 days (year), etc.

This is where I come to decide how much I’ll offer for the stock.

I’m by no means a pro, so I’m only looking ant very basic info – today’s price against the price over the past year and the price range for the day.

10% less than today’s price is not lower than what we’ve seen over the past 12 months, so I’ll offer that. This is completely up to you whether you want to offer today’s price or a discounted value. Again, to each his own here.

I place a limit order, meaning my purchase will only be complete if the ETF trade price drops to match the 10% off price I selected. I chose to keep my order “good till cancelled” which allows my “offer” to stay on the table for about 6 months, when it will automatically expire.

In English, I proposed a price for the ETF I wanted and if the market drops to meet my price any time in the next 6 months, my purchase will go through.

If the current price of that desired ETF never hits the discounted price I wanted, my offer will expire and the cash will continue to remain in my cash reserve (uninvested).

As mentioned earlier, I just “spread the love” when it comes to buying.

This is the one time in life where you get to just spend the heck out of your cash. You want this cash reserve account to be as close to zero as possible, because that means all of your money is invested and earning compound interest (score!).

I started with the most expensive fund because I know that just a couple shares of that will take the majority of my cash. It’s also the “best” fund in my eyes because it has the best track record. So I definitely want it.

Afterward I just go down my list in order of how I ranked the funds and purchased 1-4 shares of each based on the price and how much money I have left. I submitted a limit order for each fund for 10% less than the current price – so if any time within the next 6 months the market price hits my discounted price, I’ll get it.

If not, no biggie, I’ll re-evaluate and try for the next one.

There are always market fluctuations, so I take this lightly. Just because one fund takes a dip doesn’t mean I’m betting on a recession.

Since these are investments I’ll keep for 30 years, I’m betting at some point I can buy the product on sale and then ride the wave regardless of what it does.

As explained above I don’t watch the stock market daily and I’m not concerned about volatility or any level of short term highs, lows, gains, or losses. Historically speaking, the market goes in upward streaks with short-lived (although it never seems short when it’s happening) dips.

Over the 30 year long run, however, I fully expect to get those high percentage yields.

How I Selected a Mutual Fund

Another option inside of most investment accounts is that of a mutual fund.

To me, the mutual fund group was easy to narrow down, especially after going through the ETF exercise above. Whew!

Again, I chose the News & Research tab at the top of the Fidelity website and selected the obvious choice, Mutual Funds.

I used the options to select and sort for low expenses (fees), high returns, high rating, and No Transaction Fee funds very quickly. 12 choices is much better than 348!

Notice the options on the side – some of which I already selected above, the next thing I choose is a minimum investment value.

Some funds can have an extremely high minimum required investment – like 10 and 25K

I’m not quite there yet financially (ha ha) so I’m moving that little bugger over to the 2500 minimum value.

At the top, it’s easy to click on the headers and sort the information from high to low, depending on what you want to focus on.

As I clicked through the tabs at the top, I noticed that all of these funds are mid-range risk, rankings are all pretty similar, but I do a double take at this tab. I’m able to see that those Fidelity funds have no minimum investment. So even if I didn’t have quite $2500, I could still grab some.

I check the 5 “best” funds and go for the comparison tool by clicking the “compare” button.

Notice the tabs at the top again.

By just looking around in here and trying to choose just 1-2 of the 5 choices, I see that the two Awarded Fidelity funds are really the best for me.

This time it’s easy, no bidding for 10% less or judging what the stock will do today. Mutual Funds buy and sell once per day.

I decided to throw the $1,300 I had in this particular cash reserve account into the Balanced fund. The order will process at today’s market price, whatever that may be.

Again, I’m not concerned about “timing” the market or really getting any sort of “deal” because I plan on keeping this for 30 + years and riding the waves, whatever they bring.

Whichever investment options you choose, there are infinite combinations of comparison options and it could be easy to head down a rabbit trail of information overload and indecisiveness.

In fact, I’m a little worried that I’ve completely overwhelmed you by providing the info I have above, but I sure hope not!

When you’re ready to choose an investment option, don’t get caught up in market cycles, trade terms, and crazy strategies. Do your best to shoot for certain characteristics that are important to you, like maybe the percentage of growth over a 10 year period, and choose a few choices that fit that criteria in which to invest.

And always remember, you aren’t alone. Use your resources! You’ve got Google, tons of investment websites out there, plus podcasts, friends, and don’t forget about actual financial advisors. The most successful people aren’t necessarily the smartest or the most educated, they are the most resourceful, remember that.

I’m so proud of you, mama. Reach out to me if you’d like to discuss a topic further.

0 Comments